It doesnt tax the family unit. Effective January 1 2018 payers that maintain an office or transact business in CT and make payments of taxable pensions or annuity distributions to Connecticut residents are required to withhold income tax from such distributions.

Erca Income Tax Declaration Form Excel Fill Online Printable Fillable Blank Pdffiller

Net taxable rental income.

. From 6 April 2020 Income Tax relief on all residential property finance costs is restricted to the basic rate of. How much you get depends on your other income. Select the Income Tax Return for the year you wish to claim for.

More than half of Tory MPs have publicly backed their pick in the race to be PM with Rishi Sunak in the lead. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. The low and middle income tax offset is available for the 201819 201920202021 and 202122 income years and is in addition to the low income tax offset if.

Income between 11001 and 44725 22. Tax credit or exemption to tax residents of Singapore on the income derived from their. Residents of Connecticut Receiving Income from Pensions or Annuities.

If your annual gross property income is 1000 or less from one or more property businesses you will not have to tell HMRC or declare this income on a tax return. You get these allowances each tax year. The tax year runs from 6 April to 5 April the following year.

The main objective of a DTA is to provide certainty regarding when and how tax is to be imposed in the countryregion where the income-producing activity is conducted or payment is made. Employment income of non-residents is taxed at the flat rate of 15 or the progressive resident tax rates see table above whichever is the higher tax amount. Although it does recognise elements of the family in other ways.

HM Revenue Customs. If you jointly own property with your spouse or civil partner and want to change the split of income from it for tax purposes use Income Tax form 17. When youre filling out your ITR12 on eFiling you need to click yes to the question asking Did you derive income from the letting of fixed propertyies.

Income you must declare. A person adopting the presumptive taxation scheme can declare income at a prescribed rate and in turn is relieved from tedious job of maintenance of books of account and also from getting the. Your tax home is the place where you are permanently or indefinitely engaged to work as an employee or self-employed individual.

Work out which income you need to declare in your tax return such as employment government and investment income. Your tax home is the general area of your main place of business employment or post of duty regardless of where you maintain your family home. Non-resident tax rates Taxes on employment income.

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967. Income of 11000 or less 12. Here are the marginal rates for tax year 2023 depending on your tax status.

Single filers 10. I also understand that I will need to open a personal account at Bangkok Bank and transfer into it 400K from our joint account 2 months before applying for a one year visa extension based on marriage after coming to Thailand on a Non-Immigrant 0. Yes I will continue to pay US federal income tax filed by our CPA in the US.

Check whether you need to report and pay any tax on income you make apart from your main job or earnings. The Australian tax system taxes the individual Ms Morton says. The Times obtained Donald Trumps tax information extending over more than two decades revealing struggling properties vast write-offs an audit battle and hundreds of millions in debt coming due.

Employment income Declare income from your employer job including wages cash allowances and fringe benefits or super contributions. Boris Johnson flew back to the UK on Saturday and has told allies he will run - but. Super pensions and annuities.

How do I declare rental income on my tax return. If you have foreign income or foreign gains the arising basis can be complex as you will have to declare your worldwide income and gains to HM Revenue Customs using a Self Assessment tax return and may have to deal with matters of double taxation. Thank you Peter.

You may be required to complete. Under the DTAs countriesregions may provide tax breaks eg. Whats new for 202122 Low and middle income tax offset.

R 70 000 R 33 024 R 36 975. Just upload your form 16 claim your deductions and get your acknowledgment number online. The exact amount of your tax payable or refund can only be calculated upon lodgment of your income tax return.

Efiling Income Tax ReturnsITR is made easy with Clear platform. In the Non-PAYE Income page select Other Income and add Rental Income complete and submit the form. If your net rental income is over 5000 you will have to register for self assessment.

Please refer to How to Calculate Your Tax for more details. For example a taxpayer who pays 20 tax in the UK will have to declare all of their UK income in South Africa and will now be taxed on foreign. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable servicesLocal taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825 percent.

Income-tax Act ie in case of a person not adopting the presumptive taxation scheme of section 44AD As amended by Finance Act 2022. You may also use the Tax Calculator for Resident Individuals XLS 96KB to estimate your tax payable. However paying tax on the arising basis does mean that you usually benefit from the personal.

You both need to declare beneficial interests in joint property and income. The available rebates and credits include the low-income comprehensive tax rebate available to earners making less than 36000 per year the child day care credit the refundable medical care credit for taxpayers age 65 or older the special needs adopted child tax credit and the working families tax credit. Click on Review your tax link in PAYE Services.

New Mexico Capital Gains Tax. Section 10 of the Income Tax Act offers a list of conditions where income earned or at least a portion of it for services rendered outside of South African borders will be exempt from income tax. You can efile income tax return on your income from salary house property capital gains business profession and income from other sources.

Tax Payments Vector Icons Set Modern Solid Symbol Collection Filled Style Pictogram Pack Signs Logo Illustration Set Includes Icons As Percentage Paid Tax Declaration Income Taxation Money Stock Vector Adobe Stock

By Bdr In Nubank Will He Have To Declare Income Tax

Electronic Tax Declaration In Germany 2000 2021 Statista

Taxable Income What It Is What Counts And How To Calculate

I Own A Rental Property In State With No Income Tax Do I Still Need To Declare It Tfx User Guide

Freelancer Guide All You Need To Know About Your Income Taxes

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

City Of Gettysburg Income Tax Form P Tax Year 20 Ntl For Fill Out And Sign Printable Pdf Template Signnow

How To Declare Income Tax Pension And Withholding Using E Tax Portal In Ethiopia Youtube

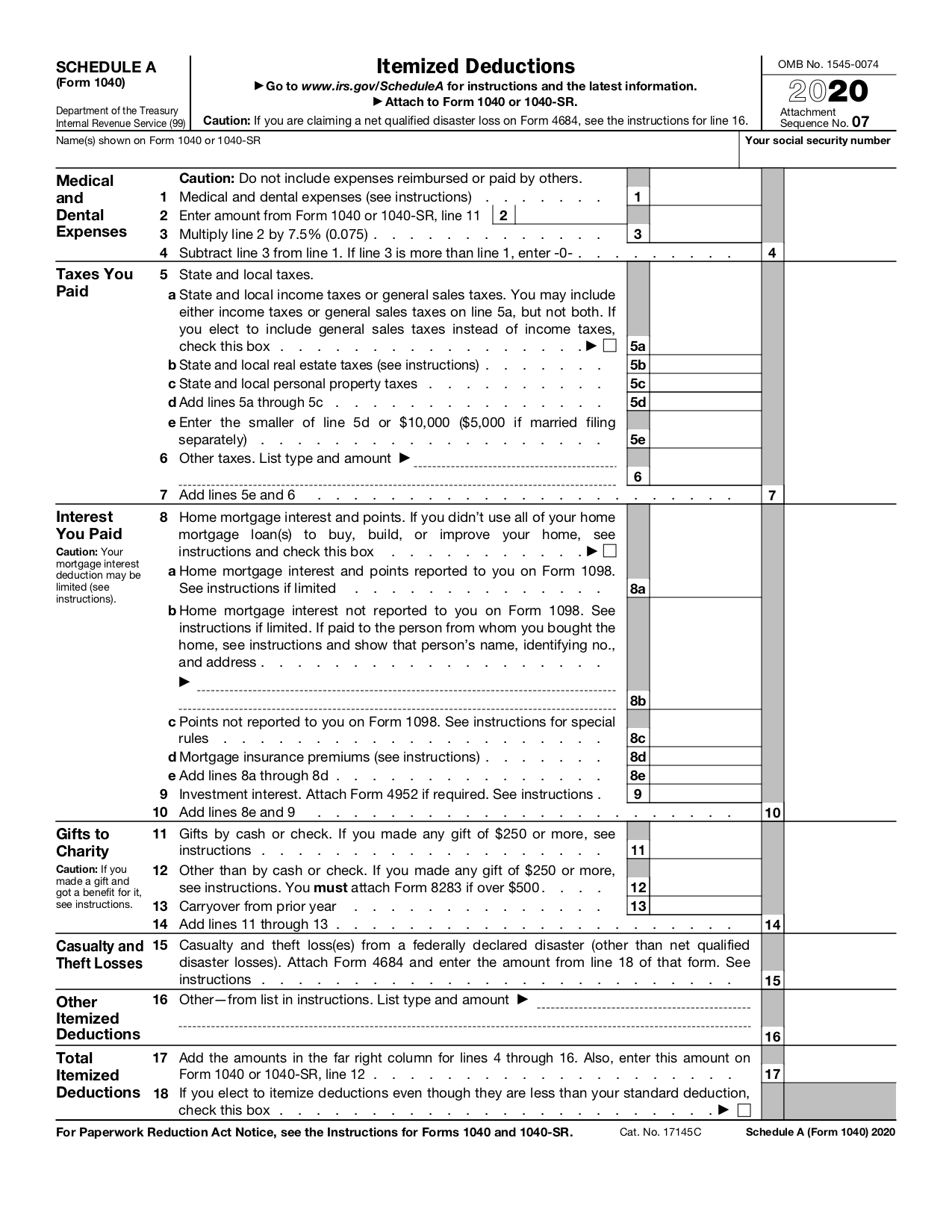

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting

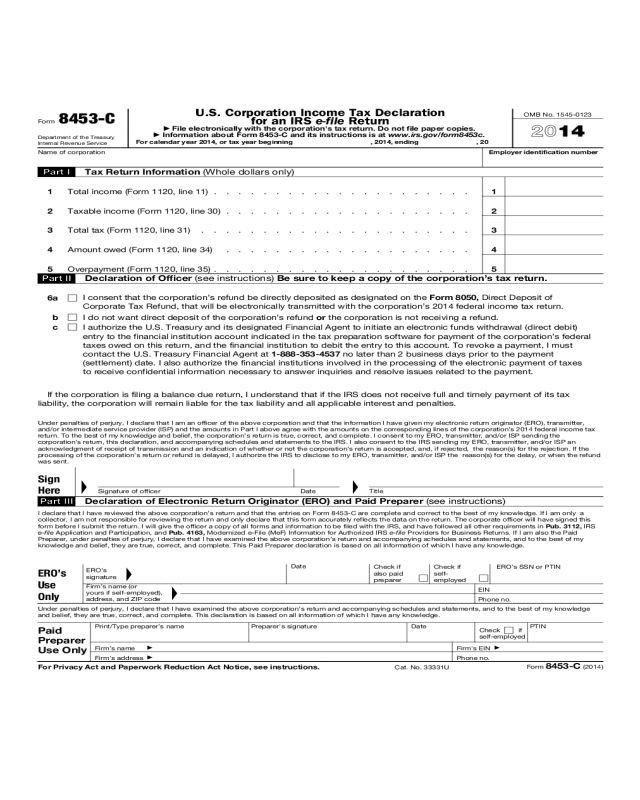

U S Corporation Income Tax Declaration For An Irs E File Return Edit Fill Sign Online Handypdf

Classification Of Income Tax Declaration Rates Based On Inspections By Download Table

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

U S Permanent Residents And Citizens Must Declare And Pay U S Taxes On Worldwide Income U S Green Card Reentry Permits

Tax Declaration Fy 2021 22 Form Template Jotform

Are You Prepared To Declare Your Us Income Tax The Deadline Is Approaching Drummond Advisors